By Rachel Wait

6/4/2022

Household budgets are being squeezed from every direction thanks to rising energy bills, record high fuel prices and soaring inflation. As a result, it’s more important than ever to find ways to manage your money more effectively, slash bills and save cash.

Take a look at these top money saving tips from leading money saving writer Rachel Wait to help you through the cost of living crisis.

Switch to budget supermarkets and brands

Fight back against rising food prices by changing where you shop. Budget retailers like Aldi and Lidl are able to offer lower prices due to their low operating costs, and their product range has grown enormously over the past few years, making it even easier to carry out your weekly shop. So if there’s one near you, now could be the time to switch to make food shopping on a budget really easy.

If you don’t have a budget store near you, consider switching to supermarket own brands instead. Most supermarkets offer value ranges as well as their own version of popular branded products which could save you hundreds of pounds a year.

Improve your driving skills and save fuel

Cut your fuel costs by improving your driving technique. Accelerating gently, easing off the brakes and driving at a steady speed can all help improve fuel efficiency. Figures show that fuel consumption rises by 15% when increasing your speed to 75mph from 60mph. Leaving the engine running unnecessarily can also waste up to two litres of fuel per hour, so make sure you turn it off when stopped for more than a few minutes.

Pay for your insurance annually

Paying for car insurance and home insurance on a monthly basis might be more manageable for your budget, but it will also be more expensive. When you pay for insurance monthly, you’re effectively taking a loan from your provider who will add interest to your bill. Where possible, always pay for your insurance annually to save money. Alternatively, if you’d struggle to find the money upfront, consider spreading the cost with a 0% purchase credit card.

Cancel unwanted subscriptions

When was the last time you had a good look through your bank statements? If it’s been a while, chances are you’re paying for something you no longer use. Keep an eye out for unwanted magazine subscriptions and memberships and make a note to cancel them as soon as possible. Doing so could save you a few hundred pounds a year.

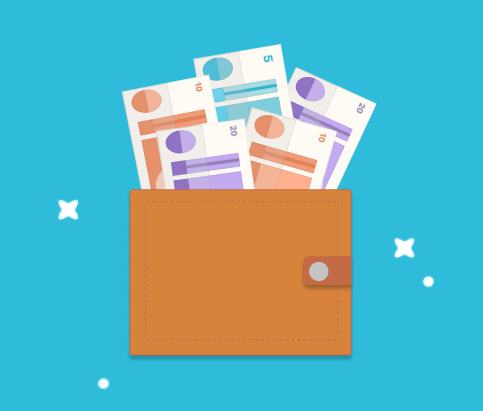

Make the most of discount codes

There’s no need to pay full price when you’re shopping online. There are often many fantastic discount codes and deals on offer for all your favourite retailers, helping you to save money. Offers can be found on huge brands across fashion, travel, tech, sports, food and drink, health and beauty, and much more - so make sure you search for one the next time you shop. And of course, a great place to start looking is right here at Savoo!

Donate to charity for free

At a time when most of us are feeling the pinch, donating to charity might not be at the top of your priority list but right now, more than ever, charities need your help. Did you know you can raise money for free just by shopping online? Simply create a free account with Savoo, choose a charity and every time you redeem a discount code or deal from Savoo, you’ll raise a free donation for your chosen charity. There are more than 400 different charities to choose from, including Marie Curie, NSPCC, Shelter, Mind and Diabetes UK.

Buy holiday extras in advance

If you’re planning a much-deserved holiday this year, make some serious savings by booking holiday extras such as car hire, travel money and airport parking well in advance. Doing so will give you more choice and flexibility, and mean you can bag the best prices. It also pays to take out travel insurance as soon as you book your holiday to ensure you won’t be left out of pocket if you had to cancel your trip for reasons such as illness or redundancy.

Replace your lightbulbs and turn off standby

According to the Energy Saving Trust, lighting accounts for 15% of a typical UK household’s electricity bill. But switching all your lightbulbs to LEDs could save you about £40 a year.

What’s more, you could save around £55 a year just by remembering to turn all your appliances off standby mode. You could even invest in a smart plug which lets you turn your appliances off standby in one go, saving you both time and money.

Switch to a SIM only deal

Happy with your mobile phone but fed up with paying through the nose for your contract? As soon as your mobile contract comes to an end, consider switching to a SIM only deal to save money. SIM only deals are cheaper because they don’t come with a new handset - instead, you get a SIM card along with a monthly allowance of calls, texts and data.

All the main networks offer SIM only deals, with prices starting from as little as £5 a month. What’s more, many deals are on a 30-day rolling contract, which means it’s easy to cancel or change to a different deal if you find something better.

Spend less time in the shower

Did you know that by reducing the amount of time you spend in the shower to just four minutes, you could save 30 litres of water a day and around £70 a year on your energy bills? Replacing your shower head with a water efficient one could also save you around £35 on your gas bills and around £54 on your water bills (if you have a water meter) each year. Amazing! (Note, these are not suitable for electric showers.)

Whether you are saving for a house deposit, or just simply looking for ways to save money to live frugally, check out our Disposable Income Analysis for more great ways to tighten your belt during the cost of living crisis.

Are you a a parent looking for ways to say money at one of the most expensive times of the year? Check out Rachel Wait's article on Top tips to make sure your kids have a magical Christmas.

Get discounts at these popular retailers with our voucher codes and promo codes

- Pets at Home

- MuscleFood

- early learning centre

- MyHeritage

- Roman Originals

- QVC

- Disney Store

- AliExpress

- Virgin Experience Days

- Jacamo

- G Adventures

- iHerb

- iScooter

- P&O Ferries

- Argos

- John Lewis

- Debenhams

- TUI

- Marks & Spencer

- SHEIN

- Very

- Buyagift

- Zavvi

- First Choice

- Dorothy Perkins

- New Look

- Karen Millen

- Footasylum

- Clarks

- H Samuel

- Ernest Jones

- Tesco

- Sainsbury's

- Interflora

- Hotel Chocolat

- Boots

- Holland and Barrett

- LOOKFANTASTIC

- The Body Shop

- B&Q

- Wickes

- Dunelm

- ao.com

- Currys

- Nike.com

- SPORTS DIRECT

- Halfords

- Myprotein

- Domino's

- boohoo

- Missguided

- HP

- Sky

- BT Broadband

- Travelodge

- lastminute

- Bulk

- Samsung

- Booking.com

- Boomf

- In The Style

- Pizza Hut

- Ted Baker

- Hive Home

- Omio

- Mindful Chef

- Amazon

- Amazon Prime Free Trial

- VonHaus

- Gtech

- BAM

- Home Essentials

- Alienware

- Gousto

- Moonpig

- Pandora

- Papa John's

- Toolstation

- eBay

- NordicTrack

- Bloom and Wild

- Quiz

- Asos

- Superdrug

- JD Sports

- Temu